It can be used by clicking the ‘technical’ tab at the top of the chart. IG charts feature MAs, as well as other technical tools like Bollinger bands and relative strength index (RSI), in order to help traders with technical analysis. MAs can be calculated manually and used in any chart analysis simply by following the formula.Īs discussed above, MAs can be used to determine levels of support and resistance. Using MAs can be fundamental for technical analysis strategies, and using a combination of techniques can result in long and short-term forecasts.

The moving average is very similar to finding the 'middling' value of a set of numbers, the difference being that the average is calculated several times for several subsets of data.

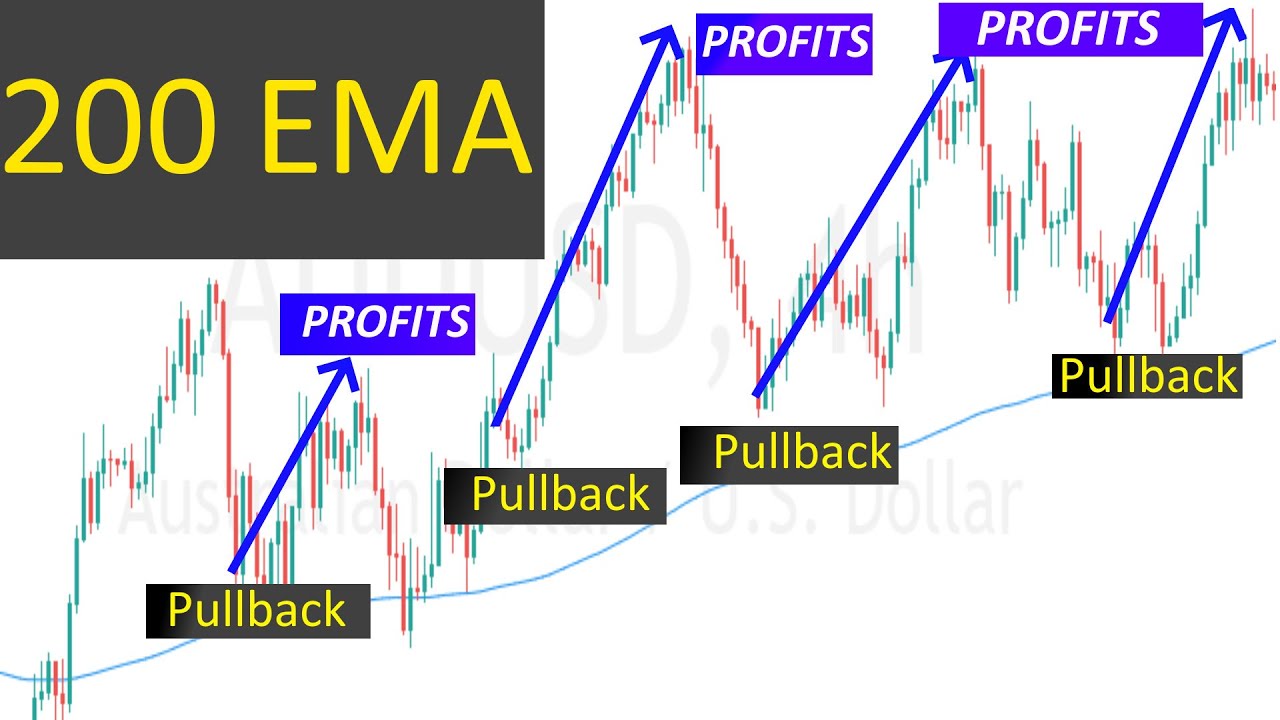

For example, if you wanted to calculate the moving average of a five-year period, you would add up the numbers over that period, and then divide by five. To calculate the MA, you simply add up the set of numbers and divide by the total number of values in the set. It can be calculated for any period of time, making it extremely useful to forecast both long and short-term trends. Once you understand the MA formula, you can start to calculate any subsets to get your MA. The MA is the calculated average of any subset of numbers, using a technique to get an overall idea of the trends in a data set. In a downtrend, a moving average can act as resistance, or a 'ceiling'. Depending on what information you want to find out, there are different types of moving averages to use.Ī moving average can be used to provide support in an uptrend, the average can act as a base ground or 'support'. There are many advantages in using a moving average in trading that can be tailored to any time frame. The MA is used in trading as a simple technical analysis tool that helps determine price data by customising average price. In stock market analysis, a 50 or 200-day moving average is most commonly used to see trends in the stock market and indicate where stocks are headed. It is a mathematical formula used to find averages by using data to find trends and smooth out price action by filtering out ‘noise’ from random fluctuations. The MA is a technical indicator used by traders to spot emerging and common trends in markets.

Put simply, the MA is the mathematical formula used to find averages, using data to find trends. Among the most popular strategies used to indicate emerging and common trends is calculating the moving average (MA). Technical indicators can make a big difference while trading.

0 kommentar(er)

0 kommentar(er)